Tax season is one of the times of the year when you can experience many emotions, ranging from fear and stress, to relief and excitement about a potential refund. Tax services in Sydney helps us to file taxes in such situations. As technology advances and improve, taxpayers in Sydney along with many others across the […]

Do you require assistance with your taxes in Sydney? Don’t look any further! Our expert team is dedicated to offering the most knowledgeable advice and guidance to make sure that your tax return is filed precisely and efficiently. We are aware of the complexity of tax law and will assist you in navigating the maze […]

Are you in search of the services of an accountant located in Sydney? With the many options available it’s a challenge to choose the best one to meet your requirements. This guide will take your through locating the most reliable accountant in Sydney making sure you make an educated choice. Do not take anything less than the very […]

Are you tired of putting in endless hours working on your taxes only to feel overwhelmed and uncertain if you’ve completed everything properly? Are you anxious about not meeting crucial dates or making expensive errors? If yes, you need to think about outsourcing your tax service to Sydney. When you delegate your tax obligations to a group of […]

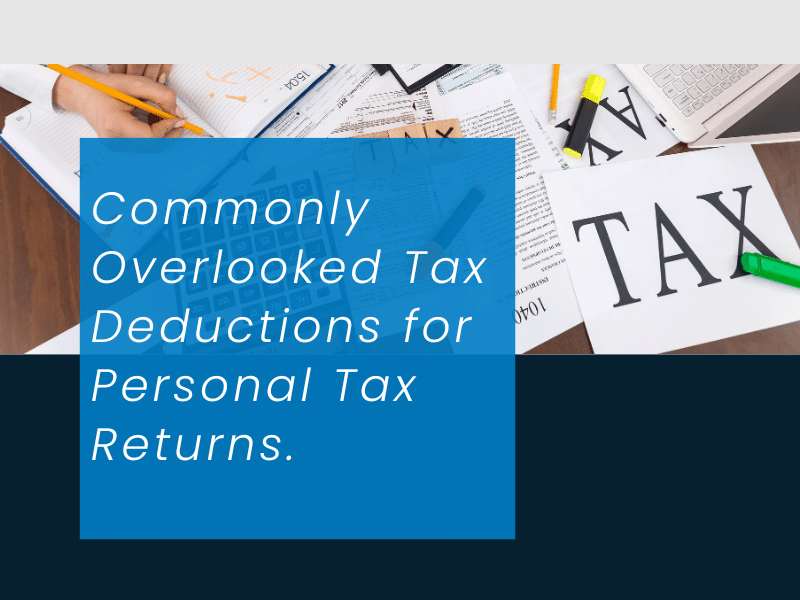

Are you fed up of paying tax more than you need to? You’re not alone. A lot of people and companies aren’t able to take advantage of tax benefits simply because they don’t know the tax benefits they’re entitled to. We’re here to assist you in maximizing your personal tax return or for your business […]

Taxes are an unavoidable part of life, so saving as much money as possible should always be top of mind. But with so many deductions and credits out there it can be daunting trying to figure out which ones apply specifically to you. Here we discuss 10 commonly missed personal tax return deductions which have […]

Tax planning is an important aspect of financial planning. Individuals and families in Australia can benefit from effective tax planning strategies that can help them reduce their tax liability and save more money for their future goals. In this blog post, we will discuss some of the top tax planning tips for individuals and families […]

When it comes to taxes, there are two main options for individuals and businesses: hiring a tax accountant or doing your own taxes. Both options have their pros and cons, and the best choice depends on your circumstances and tax needs. Hiring a Tax Accountant: Pros Expertise and Knowledge: One of the main benefits of […]

In recent years, there has been a significant shift towards digital transformation in the accounting industry. Tax accountants play a vital role in this transformation process. Tax accountants are professionals who specialize in the preparation and filing of tax returns for individuals and businesses. They are responsible for ensuring compliance with tax laws, regulations, and […]

Super contributions refer to contributions made to an individual’s superannuation fund, typically by an employer or the individual. These contributions are made on top of the mandatory contributions set by the government and are designed to boost the individual’s retirement savings. The contributions may be pre-tax, post-tax, or a combination of both and may attract […]